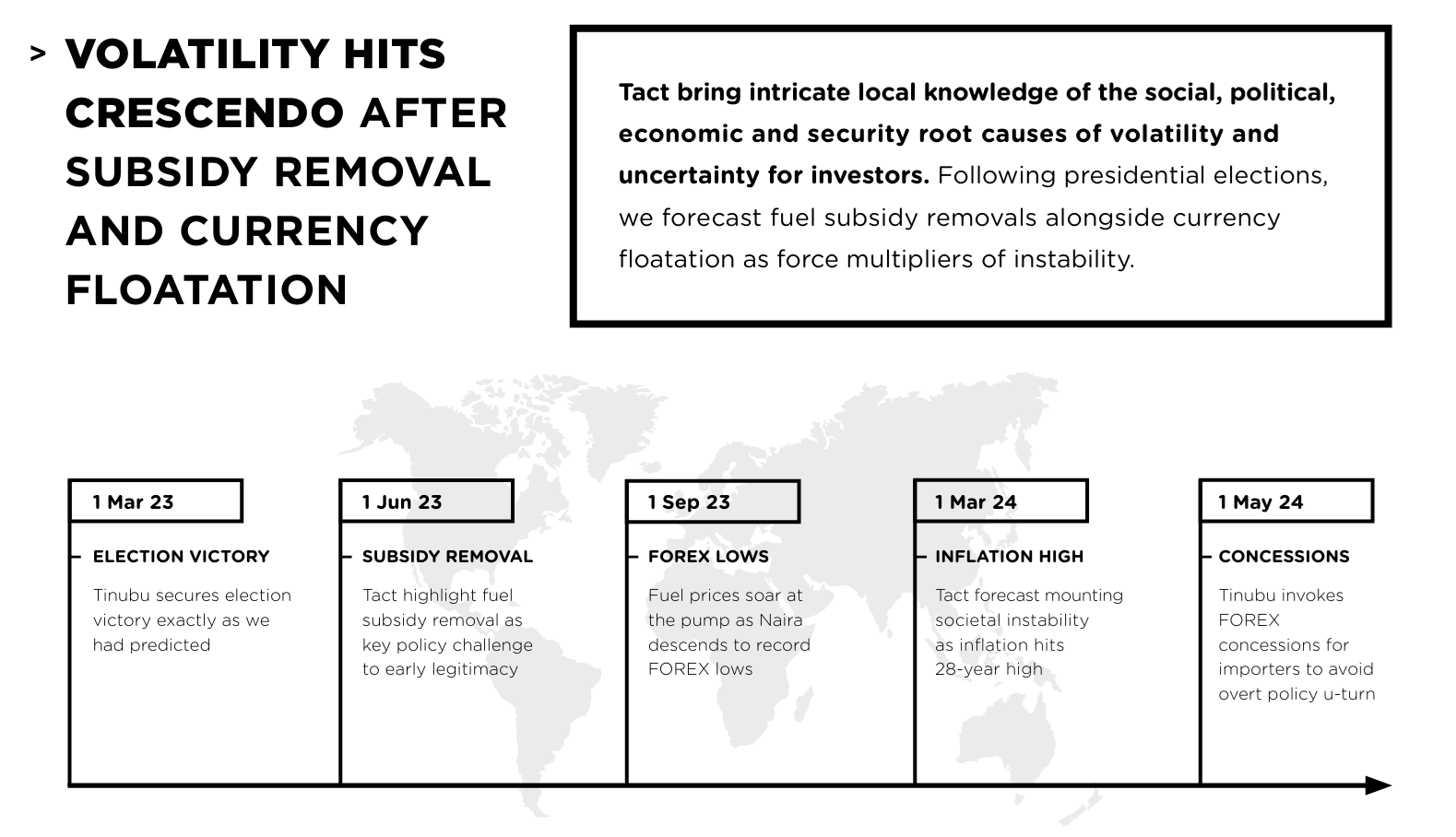

On 1st March 2023 we were looking at the impending Presidential election results. As we waited for the victor to be declared we said “we are sure that Tinubu is currently writing his victory speech.”

On 1st June 2023 we said “as we anticipated, Bola Tinubu was declared the winner of February’s Presidential election.” As he was sworn into office we noted that “the country Tinubu [inherited] is on the brink of both political and socioeconomic melt down.” We continued that “Nigerians are hungry for strong decisive leadership. They are literally crying out for change.” At the same time we pointed out that “Nigeria spent USD9.7 billion on fuel subsidies in 2022” and that “Nigeria imports all of its fuel, paying out hard currency to do so.” In the lead up to his election we said “Tinubu… promised to remove fuel subsidies. That could be risky… asking citizens to suffer hardship while squandering the national wealth will not be tolerated.”

On 1st September we wrote “Tinubu had a blistering start to his time in office. In June he removed the fuel subsidy – a move not well received… Pump prices have soared plunging even more people into poverty and firing up already painfully high inflation levels… everything points to Tinubu… reversing his decision and implementing a ‘temporary’ subsidy.” When looking at the economy we said “Tinubu’s aggressive reforms have shaken more than just his nerve; they have shaken markets, exchange rates and investments too. The Naira now trades at a record low against USD and shows no signs of strengthening without decisive direction.”

By 1st March 2024, we assessed “Tinubu seems to be in a rush to restructure Nigeria so much so that it is beginning to feel slap-dash with no back up plans or consideration of consequences… We are in for a roller coaster over the next few months so strap in tight – it is going to be quite a ride.” We also made the observation “Inflation continues to soar, reaching 29.9% in January, its highest rate since 1996. The Naira continues its crash and burn trajectory plummeting to NGN1,624 to USD1… Nigerians have seen their currency depreciate by over 100% since… June [2023]”. With sadness we said “we have already seen protestors take to the streets… as the cost of living soars and we predict we will see more.”

Fast forward to May 2024 and Tinubu had subtly u-turned on his fuel subsidy removal decision. Instead of reversing the policy he has instead quietly tweaked it by providing special foreign exchange concessions for product importers which, although prices for fuel remain elevated, has kept costs within a range that is almost manageable. Even so, it doesn’t take an economist to see just how much hard currency that will be eating up. And then there is the Naira. By May 2024 it was USD1 = NGN1,452.49. On 1st March 2023 this rate was NGN460.

Putting these two things together, we can see that the subsidy removal and floatation of the Naira ignited a fire under the inflation rate. In February 2024, food inflation reached 37.92% and shows no signs of slowing – in fact we are looking at years before we see it coming under any real control. Increased fuel prices will continue to trickle down the hiked operation costs onto consumers pushing prices higher still. Now we wait for Tinubu to lay out a clear economic plan that will tackle inflation, promote stability, and attract investment but his misguided and badly implemented subsidy policy has rattled him so it will take him a while to regain his confidence. And while we wait, cost of living protests will continue.