-

American Nero

We are living through tumultuous times, the end of an era, the beginning of a new epoch. Since 1947 the United States of America (USA or US) has dominated the planet, becoming the sole hegemon with the fall of the Union of Soviet Socialist Republics in 1991. Thanks to the stability that… Read more…

-

Gold Just Crashed. That Doesn’t Change the Point. It Proves It.

Gold prices are falling fast. After weeks of record highs and breathless commentary, bullion has dumped hundreds of Dollars in a matter of hours. Silver has followed. The dollar has snapped back. Markets, suddenly, look calmer. The trigger had a name – Kevin Warsh. President Trump’s move to line up Warsh as… Read more…

-

International Relations Theories & Today’s World

To try to make sense of the last twelve months, and more, it is important to understand the variety of theories that seek to explain events, decisions, and outlooks. There are several schools of thought in the study of International Relations. All of them are valid to one degree or another when… Read more…

-

Egypt’s Gold Bank Is Not About Gold. It’s About Control

At first glance, Egypt’s announcement sounds technical. Africa’s first specialised gold bank. Refining. Vaulting. Trade finance. Another MoU, another promise. But look closer and it’s something else entirely. This is about who controls value, who controls reserves and who controls the pipes when geopolitics turns hostile. Let’s get one thing straight upfront.… Read more…

-

The US’ Drugs Problem is Domestic, not International

In recent weeks the US has struck alleged narcotics smuggling boats and kidnapped a foreign head of state. One excuse given for these attacks was that Venezuela was responsible for some of the flow of narcotics into the USA. Here we dismantle this facile argument because, for all this force projection, Washington… Read more…

-

Somalia Is No Longer a Peripheral Concern. It Is a Geopolitical Battleground.

Somalia now sits at the intersection of three strategic systems: the Nile basin, the Red Sea corridor and the Middle East security competition. That alone should make it one of the most geopolitically sensitive territories in Africa. It rarely gets treated that way. The Red Sea carries a large share of global… Read more…

-

When Institutions Become Optional

Institutions have not collapsed. They have been outmanoeuvred. What we are watching now is not the failure of the post-war order, but its quiet circumvention. Power no longer needs to break institutions to get what it wants. It can move through them, around them and, when necessary, in spite of them –… Read more…

-

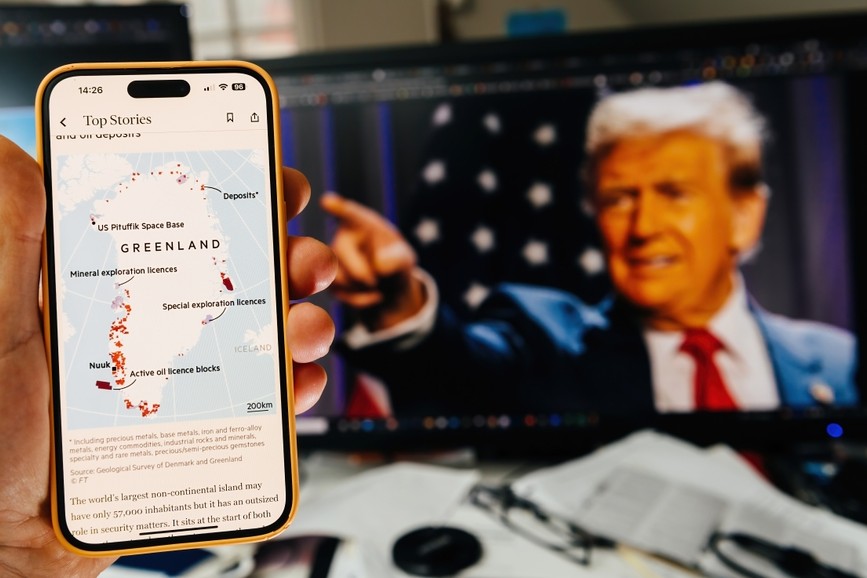

The Great Game Is Back – Now Stripped of All Pretence

What we are witnessing now is not a new world order. It is an old one returning – not fully restored, but no longer restrained. The language may be modern and the tools more sophisticated, but the logic is unmistakably familiar. Powerful states are asserting their entitlement over space. Borders are treated… Read more…

-

Venezuela and the End of Constraint

Venezuela is not the story – permission is. When the United States moves to impose control over Venezuela, openly citing narcotics, or oil, or proximity, or presidential dislike, it is not simply intervening in Latin America. It is signaling that power, not restraint, now defines the outer boundary of acceptable behaviour. This… Read more…

-

Five Predictions for 2026 That Matter

2026 will not be defined by a single shock or turning point. Instead it will be by the cumulative impact of policy uncertainty, geopolitical friction and capital repositioning. The old anchors are weakening and markets will be forced to discriminate more aggressively. These are the five calls that will matter most. 1)… Read more…

-

When Inflation Stops Mattering: The New Geography of Strategic Capital

Investors aren’t supposed to behave like this. Conventional wisdom says foreign investors will run from high inflation. In theory no one should be sending long term capital to countries where 30% price growth wipes out real returns before you’ve even taken off your jacket. Yet in 2025, as one analyst put it,… Read more…

-

Why Washington Stepped In: Inside the $40 Billion Bailout

We’ve just seen the biggest US intervention in a foreign market in years and it happened in the middle of a government shutdown. Argentina didn’t just get a bailout. It got a guardian. The Mechanics: How the Money Moved Without Congress Officially, this isn’t a bailout. Washington calls it a currency-swap arrangement… Read more…