The headlines are comforting. Egypt’s debt on track to hit lowest level since 2016 by 2030, says the IMF. Ahram Online dutifully reported it while Cairo’s officials echoed the optimism. But if you look behind the tidy slope of those projections you will see there is a more complicated reality. It is one that depends less on arithmetic and more on endurance, credibility and, most of all, luck!

The Numbers the IMF Actually Shows

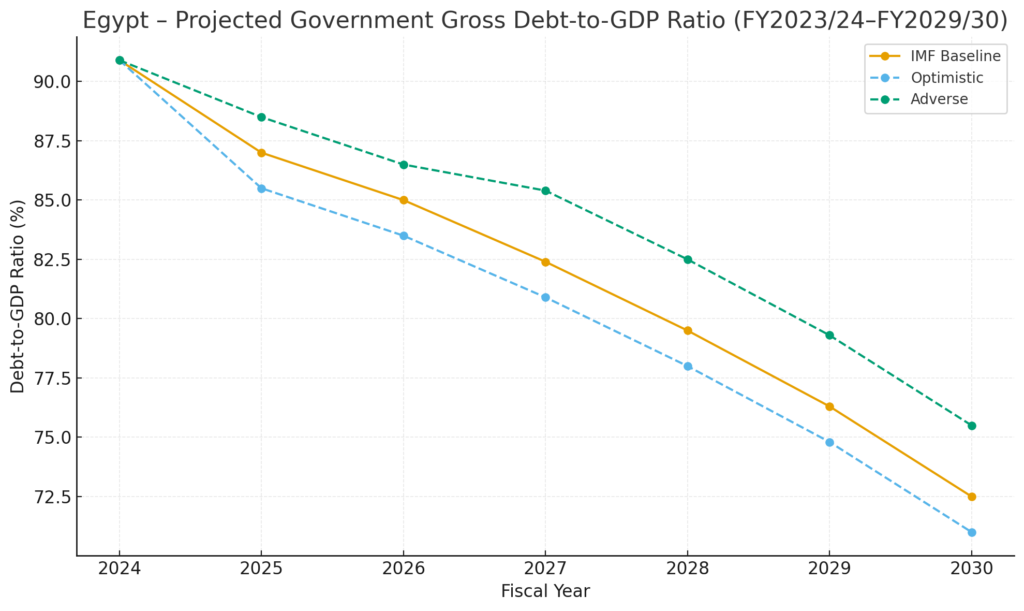

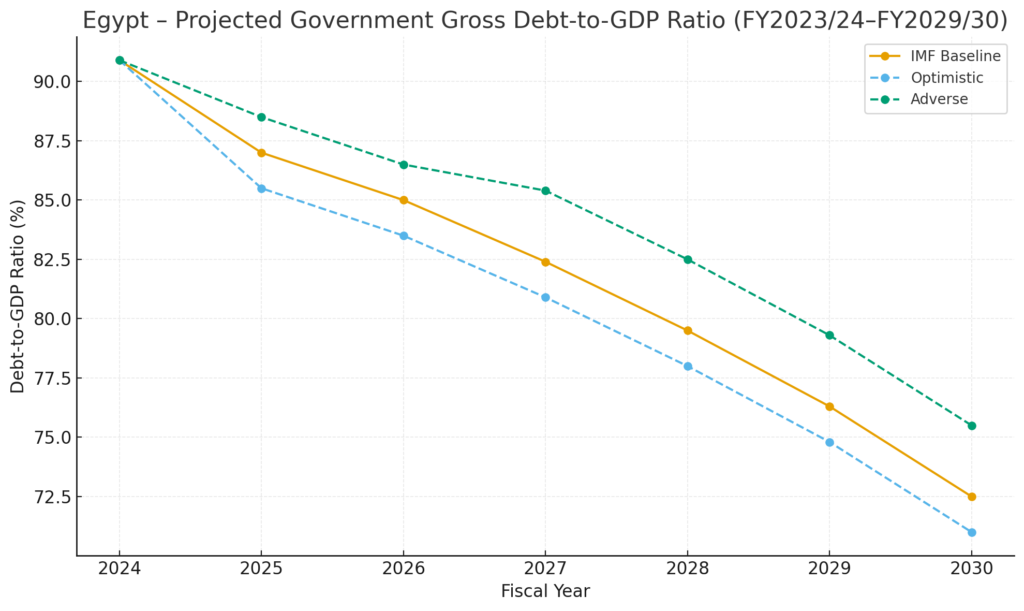

According to the IMF’s latest Fiscal Monitor, Egypt’s general government gross debt stood at 90.9 % of GDP in the 2023/24 financial year. The baseline forecast projects a slow descent to 72.5 % by FY 2029/30.

That trajectory looks smooth enough on paper but it is conditional. It relies on steady growth, stable financing and sustained primary surpluses of 4 to 5 % of GDP for five straight years.

Below is the IMF’s own path (baseline) contrasted with plausible optimistic and adverse cases, reflecting faster reform or weaker growth and higher borrowing costs.

What the Scenarios Tell Us

Under the IMF baseline, debt declines gently – about 3 percentage points per year – as growth recovers and the pound stabilizes.

Under a stronger reform case, faster GDP growth and disciplined budgets could drive debt toward 65 % of GDP by 2030.

But under a stress case, where interest costs rise and growth falters, the ratio barely falls – hovering near 85 %.

This is not alarmist. It is precisely what the IMF’s own Debt Sustainability Analysis warns – Egypt faces a “high risk of sovereign stress.” Even small shocks like a weaker pound, slower growth, or higher global rates, would flatten the curve entirely.

Growth Matters More Than Promises

Debt reduction is as much about the denominator as the numerator. Egypt’s GDP growth, which the IMF pegs at around 4 to5 %, could easily slip if external shocks persist or if fiscal tightening bites too hard.

In an optimistic environment – think peace in the region, steady capital inflows and effective reform – growth could edge above 5 %.

In an adverse world – think higher global rates, sluggish exports and Red Sea disruptions – it might struggle to stay above 3 %.

Each percentage point of missed growth adds roughly 3 to 4 points to the debt ratio by 2030.

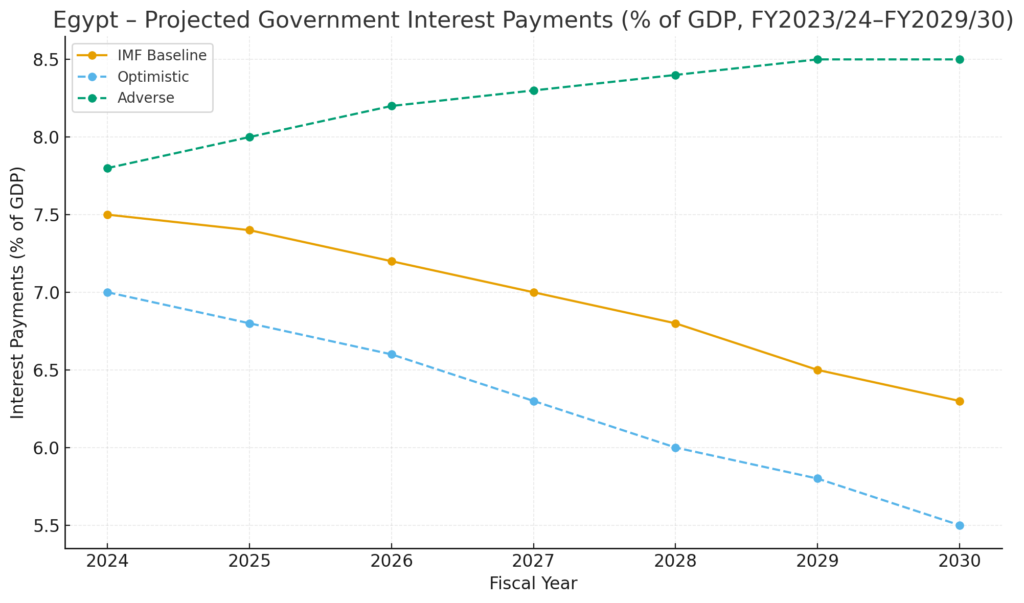

The Hidden Weight of Interest

However… What rarely makes it into the headlines is the interest bill. Namely? The part of the budget being eaten by past borrowing. Egypt currently spends over 7 % of GDP on interest payments – a number that puts it among the highest in the emerging world.

Even if debt falls, the cost of servicing it will remain punishing unless the structure of borrowing changes.

In the optimistic case, interest costs fall below 6 % of GDP.

In the adverse one, they rise above 8 %, crowding out health, education and investment.

What the Article Didn’t Say

Al Ahram’s upbeat narrative misses several inconvenient truths.

- The projections assume a near perfect execution of fiscal reform for five consecutive years. Yes – you read that right. This is an extraordinary political ask.

- The exchange rate risk remains acute. Much of Egypt’s debt is foreign currency denominated.

- Off budget and contingent liabilities – think if everything from state-owned enterprises to public-sector guarantees – are excluded from the headline ratio.

- External shocks have become structural, not cyclical. They are now the baseline. Suez Canal revenues have already dropped USD6 billion since 2024.

The IMF itself lists these as high probability hazards. Yet local coverage has reduced them to mere footnotes.

The Real Test: Sustaining the Primary Surplus

Egypt’s fiscal plan relies on running a primary surplus of 4 to 5 % of GDP for years on end. And let’s be honest…. These are levels few emerging economies can sustain without growth miracles or painful cuts.

Achieving that would require widening the tax base, curbing quasi-fiscal spending and re-prioritizing investment. All of that while managing inflation and social pressures.

In short… This is not a spread-sheet problem. It is a political one.

A Recovery on Conditional Terms

Egypt can indeed reach its lowest debt ratio since 2016 but only if the assumptions hold. The IMF’s path is not a prediction. Instead it is a conditional promise.

Debt will decline if – and only if – growth accelerates, inflation remains contained, external financing stays available and reforms stay on track. That is a whole lot of ifs.

The Bottom Line

The numbers may suggest progress but the reality is that Egypt’s debt story is one of resilience under stress, not relief from it.

By 2030, the ratio may look lower but, unless the structure of the economy changes, the burden will feel just as heavy.

Optimism sells. Sustainability doesn’t. It is time Egypt’s debt debate recognised the difference.